Power of Compounding in Mutual Funds

Albert Einstein once called compounding the “eighth wonder of the world.” But what makes it so magical, especially when it comes to mutual funds? Let’s dive in.

📈 What is Compounding?

Compounding is the process where your investment generates returns, and then those returns start generating returns themselves.

It’s the snowball effect — where your wealth grows not just from your initial capital, but also from the profits you earn over time.

💡 Simple Example

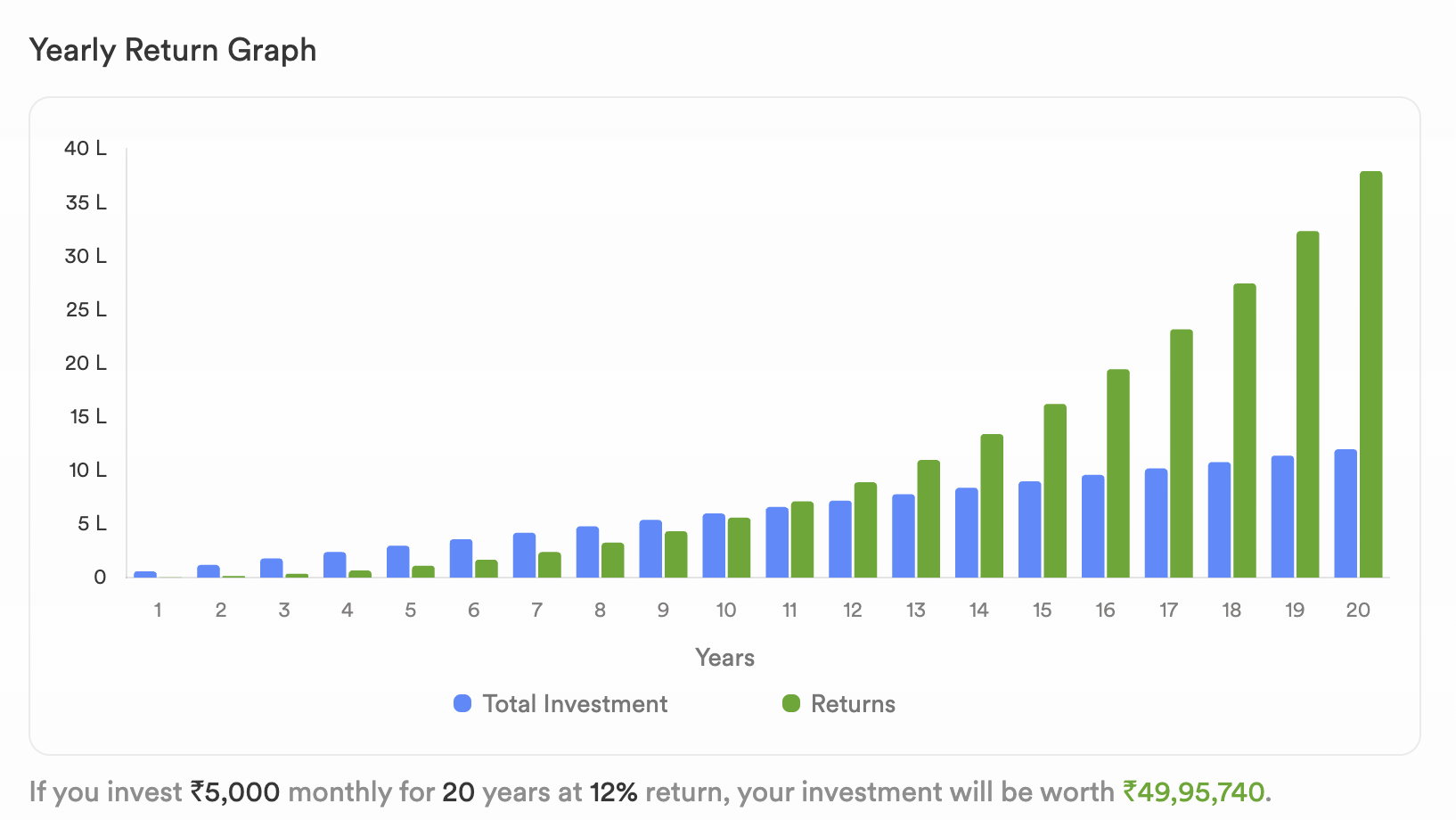

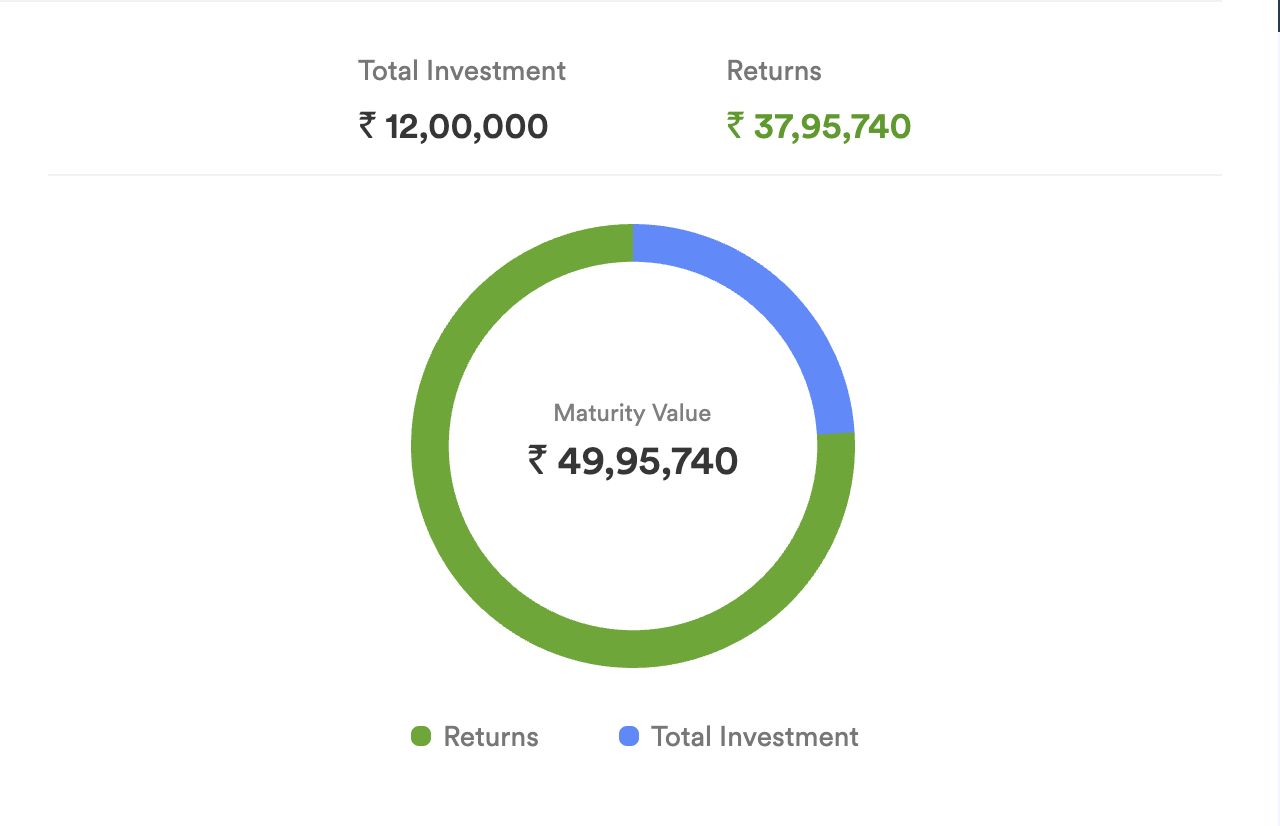

Let’s say you invest ₹5,000 every month in a mutual fund that gives you an average return of 12% per annum:

| Time | Monthly Investment | Value Grows To |

|---|---|---|

| 5 Years | ₹3,00,000 | ₹4,10,000+ |

| 10 Years | ₹6,00,000 | ₹11,60,000+ |

| 20 Years | ₹12,00,000 | ₹49,00,000+ |

The difference? Compounding!

🔁 The Rule of 72

Want to know how long your money will take to double?

Use this formula:

72 ÷ annual interest rate = time to double

At 12% return:

72 ÷ 12 = 6 years

So your money will double every 6 years if you stay invested.

🧠 Key Learnings from Ankur Warikoo

Inspired by Ankur Warikoo, who simplifies financial wisdom for young Indians, here’s what he stresses:

- Start early: Time is your biggest asset.

- Invest consistently: Don’t wait for the “perfect” time.

- Don’t withdraw frequently: Let compounding work undisturbed.

Even if you start small — say ₹500 or ₹1,000 a month — the results over a decade are massive.

🚀 You Don't Need a Demat Account

That’s the best part — to invest in mutual funds, no demat account is required. All you need is:

- Your PAN

- KYC documents

- A mutual fund platform

I personally recommend AssetPlus. You can start investing here:

👉 Start with AssetPlus →

🎯 Action Plan

- Decide your monthly investment (even ₹500 is great!)

- Choose a good mutual fund (preferably SIP in index funds or large-cap funds)

- Be consistent for at least 5–10 years

- Avoid panic during market dips

- Track your progress annually — not daily

🧮 SIP vs Lumpsum — Which is Better?

- SIP (Systematic Investment Plan) lets you build wealth slowly, reduces risk via rupee-cost averaging.

- Lumpsum can benefit from market timing, but carries higher risk.

For beginners, SIP is ideal — it's automated, disciplined, and minimizes emotions.

🔒 Final Thoughts

The power of compounding is real — but it requires two things:

- Time

- Patience

Every day you delay investing, you miss the exponential curve that could’ve changed your financial life.

So, don’t wait.

Start small, stay consistent — and let compounding take care of the rest.

Try out our tools:

👉 SIP Calculator – Estimate how your monthly investment grows over time.

📈 Step-Up SIP Calculator – See how increasing your SIP each year can significantly boost returns.

Let’s build wealth the smart way!